Online Customer Communities, Innocent Drinks & TomTom

Last week, I attended the European Customer Experience World conference at the Hilton T5 Heathrow, and chaired the social media stream on the first day, where we had 3 great speakers, Joe McEwan, from Innocent Drinks, Jonathan Browne from Forrester and Kenneth Refsgaard from TomTom.

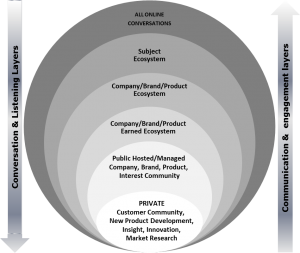

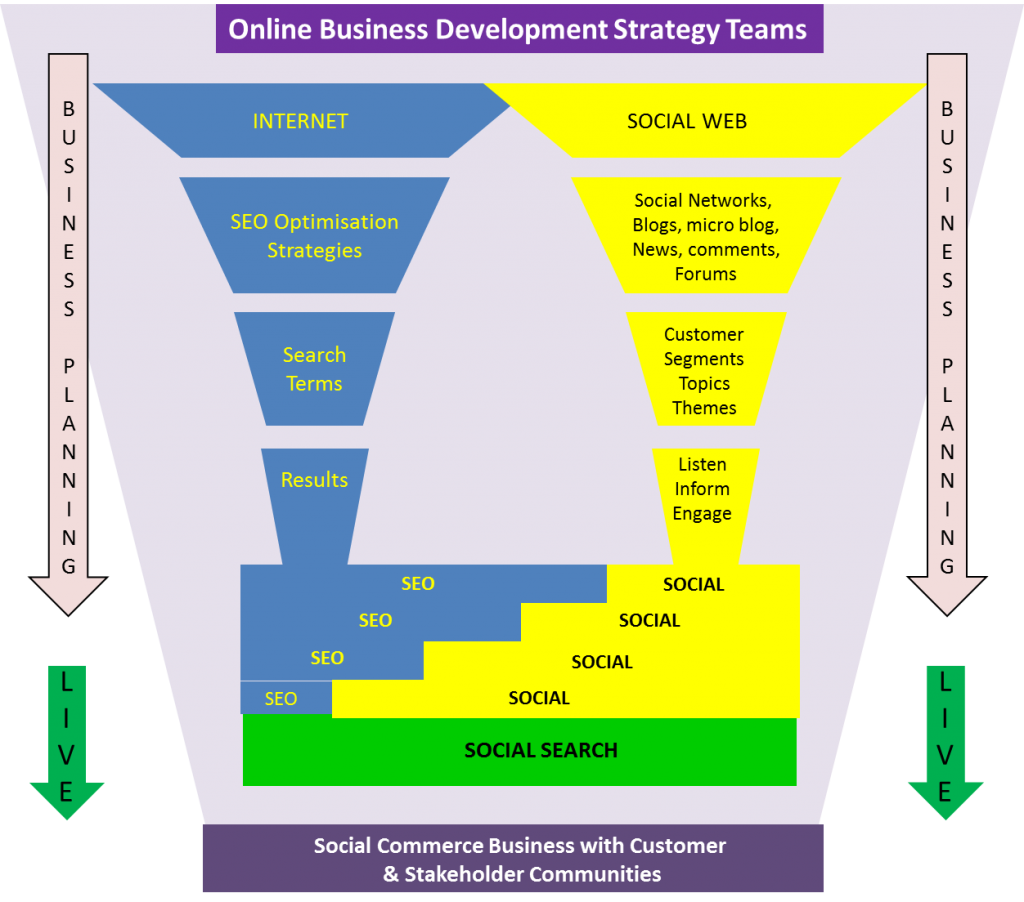

Each of our speakers provided insights into how different companies are creating connections with their customers through online communities, what struck me was the difference between Innocent Drinks and TomTom in their approach to creating and connecting with their customer communities.

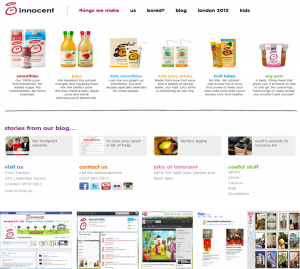

From the start, Innocent Drinks have had a close connection with their customers, from the sale of the first bottle of their crushed fruit drinks at a Music Festival to today, where they engage with them across multiple channels, online, on their packaging and through their events like this years innocent fruit sports day in regents park.

The culture of innocent drinks is fun, collaborative and enthusiastic and it is their ability to communicate this to their customers and create emotional connections with them creating ongoing dialogue and include them in their various initiatives with great success. The primary channels used by innocent drinks are their website, blog, facebook page, twitter feed, youtube channel, flickr and Instagram.

On the other hand TomTom is a different type of company, selling technology based products, which attracts a different kind of enthusiast and advocate than innocent drinks. innocent drinks, have brand advocates who identify with the culture of the company, the fun lifestyle reflected in their communication, packaging and events where TomTom advocates have a keen interest in technology, what it does, how it works, the problems it solves and share their technical knowledge with each other helping to resolve product support issues.

TomTom provides a range of communication channels for their customers, their website, a hosted customer community, facebook page, twitter feed, youtube channel, linkedin careers group and google+ page, all of which are managed by the TomTom community team. TomToms’ hosted community partner is Lithium who provide both the hosted platform plus the expertise in growing and developing an active and vibrant community.

TomTom use their social channels to communicate with and facilitate conversations between their customers as well as informing prospective employees about current opportunities and life at TomTom.

Both organisations have successfully created an engaged customer community, however both their initial approach and on-going conversations are different. The following table highlights some of the key areas and the differences between the 2 companies:

| Community Strategy | Innocent | TomTom |

| Primary Business Goal | Brand Advocacy & Marketing | Customer support |

| Approach to growing community | Organic with the business | Hosted community launched on a specific date |

| Strategy | Evolving, learn as they go | Structured strategy for hosted community |

| Communication Channels | Combined offline/packaging/online web and social and live events | Strategic Initiative – customer |

| Contact with Brand | Direct | Direct |

| Communication Tone | Responsive and reflective of consumer conversations | Responsive – allow community to solve each other’s problems, with TomTom support where necessary or if community slow to respond |

| Primary communication direction | Brand to consumer and consumer to Brand | Peer to Peer – facilitate customer to customer with internal brand support and knowledge |

| Feedback | Product Feedback channel – innocent respond to customer feedback on products – altered flavour of Thai Pot | Product feedback channel – used by NPD and innovation teams |

| Management | Small team with access to whole company – all departments | Small team – primary function is support but can feed to others where necessary |

| ROI | Not primary focus, as customer conversations and accessibility of internal teams is part of company DNA | ROI is related to customer support cost savings, which are measured and reported. |

| Geography | International site with international communication | International site with international communication |

It would be good to hear your feedback on these observations or your own experiences of creating and developing online communities, please leave a comment or contact me directly.